The 2-Minute Rule for zero down bankruptcy virginia

Show up at a affirmation Listening to where a choose will overview your petition and decide For those who have the signifies to abide by via together with your proposal. According to that decision, you will both transfer ahead with Chapter thirteen, modify the approach or file Chapter seven bankruptcy instead.

The money gained in a very tax refund is one area many People in america anticipate. In fact, it isn’t typically that the governing administration mails you a Test only for accomplishing what you’re alleged to do.

Acquiring a spending plan that accounts for your altered monetary scenario, saving for emergencies, and organizing for long run tax liabilities will be vital actions in this process. Engaging by using a monetary advisor or continuing to work with your bankruptcy attorney can present you with procedures and guidance tailor-made on your new money landscape.

At the very least every week just before this Conference, you will need to present all requested monetary paperwork into the trustee, which include pay back stubs, lender statements, 4 years of tax returns, as well as other records including expenditure and retirement account holdings.

Debt Settlement – It’s normally much better than bankruptcy, but not by A great deal. A debt settlement organization negotiates with creditors to cut back Whatever you owe in Trade to get a lump-sum payment plan that you just commit to for 2-three years.

For those struggling with chapter seven bankruptcy, though, keeping the money been given from their tax refund is not really usually certain. Generally, the resolve on whether you maintain your tax refund or not is produced dependant on the timing of both equally your receipt of that refund and when you file for bankruptcy, but There are many approaches to aid Extra resources be certain that you get to help keep your hard earned money.

Harness the strength of advanced analytics and machine Discovering algorithms seamlessly integrated right into a person-helpful interface, tailored to meet the distinctive knowledge their website needs of one's Corporation.

The information on this Site is for general information uses only. Nothing at all on This great site ought to be taken as legal tips for virtually any unique scenario or problem.

Essentially, Chapter 13 buys you time for you to Obtain your financial act with each other. It extends the length of time It's important to repay what you owe following the bankruptcy courtroom challenges its ruling.

Soon after finishing all payments with the Bonuses confirmed Chapter thirteen approach, the court discharges your bankruptcy, which cancels the balances of qualifying debts. This doesn't consist of long-expression obligations just like a home property finance loan, debts for alimony or baby assistance, and specified taxes.

Have you been anxious you will have to surrender your automobile, truck or market your boat? We can make clear what belongings you are able to hold (over you may think).

• Notable: This ranking signifies the attorney has long been look at here regarded by a large number of their friends for strong ethical criteria.

The sort of bankruptcy you file can appreciably have an effect on your tax return. In Chapter 7 bankruptcy, certain different types of tax debts could be discharged solely. In contrast, Chapter 13 bankruptcy generally consists of tax debts in a very repayment plan, enabling you to pay them in excess of a period of time.

Your qualification can be based on authorities help eligibility, earnings level, geographic location, age team, and other conditions. Verifying with my review here the lawful provider provider whether you are qualified for their guidance in advance of proceeding with more discussions is essential.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Tatyana Ali Then & Now!

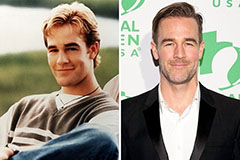

Tatyana Ali Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!